As your family home is not counted in the assets test, there may be a good case for paying it off, notes Kate Rolfe, retirement experience lead at Aware Super.

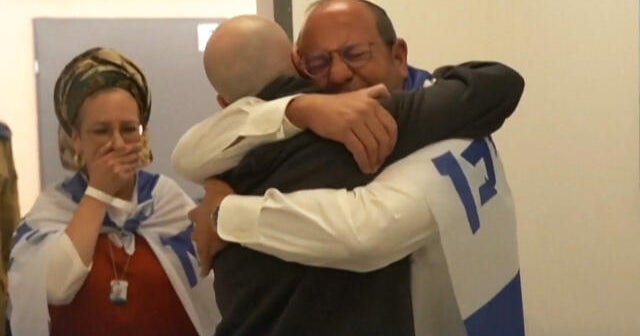

Kate Rolfe, retirement experience lead at Aware Super.

“Paying off your mortgage can reduce your assessable assets, potentially increasing your pension entitlement,” Rolfe says.

How does super affect eligibility for the pension?

“Superannuation impacts the age pension through both the assets and income tests. Your super balance is considered an asset, and any income generated from it, including from income streams, is factored into the income test,” says Chapman. Super accounts and account-based pensions are subject to deeming when calculating your assessable income.

How is gifting assessed?

Loading

You may think that giving income or investments to the kids or grandkids will get you under the income or assets test limits. However, it’s not that simple.

Chapman says: “If you give away your income or assets, they may still count towards your income and assets tests. This also applies if you sell them for less than they’re worth.” Centrelink assesses whether your assets go over the ‘gifting free area’.

This area, or limit, is the same for singles or couples: if you give away less than $10,000 in one financial year, or $30,000 over five financial years (with no more than $10,000 in a single financial year), it doesn’t affect your pension.

“If you go over the value of the gifting free area, it will affect your payment,” Chapman says.

Giving away assets in the years immediately before you get the pension is also assessed. “Any gifts you made in the past five years may be included in your income and assets tests,” Chapman says.

What about structuring assets before retirement?

“To effectively restructure assets before retirement, focus on maximising your retirement income while managing your risk and potential tax implications,” Chapman says.

“This involves reviewing your investments, understanding your superannuation, and considering estate planning options.” Chapman recommends consulting a financial adviser to help you through the process.

“Get expert guidance on structuring your assets and maximising your retirement income,” he says.

Mark Chapman, director of tax communications at H&R Block.

How important is timing?

Rolfe says it’s important to apply for the age pension before you’re 67. “You can apply up to 13 weeks before you turn 67, and if approved, payments will start from your 67th birthday,” she says.

“Since payments are only backdated to either your eligibility date or application date, whichever is later, applying early ensures you don’t miss out on any payments you’re entitled to.

And if you don’t qualify for the age pension now, keep monitoring your situation in case that changes.

“Eligibility can change as you draw down savings,” Rolfe says. “Regularly review your financial position with Centrelink to make sure you’re not missing out.”

For more information on the age pension, head to the Services Australia website.

- Advice given in this article is general in nature and is not intended to influence readers’ decisions about investing or financial products. They should always seek their own professional advice that takes into account their own personal circumstances before making any financial decisions.

Get workplace news, advice and perspectives to help make your job work for you. Sign up for our weekly Thank God it’s Monday newsletter.