This week’s Bulls N’ Bears ASX Runner of the Week is… ASF Group Limited.

ASF GROUP LIMITED (ASX: AFA)

Up 4900% (0.7c – 35c)

Easily burying the competition this week is investment house ASF Group Limited, which surged a massive 4900 per cent after its subsidiary, ASF Capital, officially registered with AUSTRAC as a Digital Currency Exchange provider, effective for the next three years.

ASF is a diversified investment and trading company headquartered in Sydney, Australia, with a focus on identifying, incubating, and realizing opportunities mainly in resources, with investments in emerging junior ASX goldie ActiveEX and two Queensland coal companies in Rey Resources and CMR Coal.

The digital currency move expands ASF’s reach into regulated digital-asset services alongside its existing financial services licence.

It allows the company to facilitate compliant exchanges between fiat and digital currencies under Australia’s anti-money-laundering laws.

As much as the ability to facilitate exchange between fiat and digital currencies is impressive, there are about 400 other providers in which AUSTRAC extend that privilege to.

With banks, governments and financial institutions investing more in stablecoins and digital currencies every day, it is prominent but not exactly new or novel.

Perhaps the tightly Chinese-held stock taking off was more to do with its extremely tight register than anything else, with the top 20 shareholders holding 90 per cent of the paper on issue.

The news came through Wednesday morning and punters saw their opportunity. Pushing ASF’s price quickly up from just 0.7c a share to a whopping 35c on just $70,000 in stock traded for a lazy 4900 per cent gain before the ASX stopped the party with a speeding ticket .

The company’s market cap had hiked from roughly $5 million to a dizzying $277 million by Wednesday mid-morning, before the ASX put a stop to the nonsense – clearly still reeling from the 8300 per cent Kaili Resources fiasco just a few months ago that some say should have been stpped earlier.

ASF’s run was a mixture of digital currency fever, a decent regulatory approval, a tight capital structure and likely a few ASX traders playing funny buggers with the stock.

Vectus Biosystems has sold its renal fibrosis molecule to NASDAQ-listed XORTX for $4.5 million.

VECTUS BIOSYSTEMS LIMITED (ASX: VBS)

Up 157% (7.4c – 19c)

Snagging silver on the Bulls N Bears Runners of the Week podium is Drug discovery and development company Vectus Biosystems. The Melbourne-based drug development company shot up on news it had sold its VB4-P5 renal fibrosis compound for $4.5 million in shares and warrants to Nasdaq-listed XORTX Therapeutics.

The Canadian kidney treatment specialist will offer Vectus $4.5 million in XORTX equity for its intellectual property and data transferred.

The company says it will now redirect funds to its lead VB0004 cardiovascular program, which is now entering IND-enabling studies.

The extended Vectus stable also features its VB4-A32 liver fibrosis targeting, VB4-A79 for pulmonary conditions including black lung and IPF. AccuCal-D platform which quantifies DNA and RNA faster and cheaper than the competition.

The company says its VB0004 is able to halt and even reverse scar tissue, a major development in modern medicine.

The novel treatments and company strategy was not lost on the market, as its shares flew up from 7.4c at last Friday’s close to 19c on the announcement, up 157 per cent on some $1.2 million in volume.

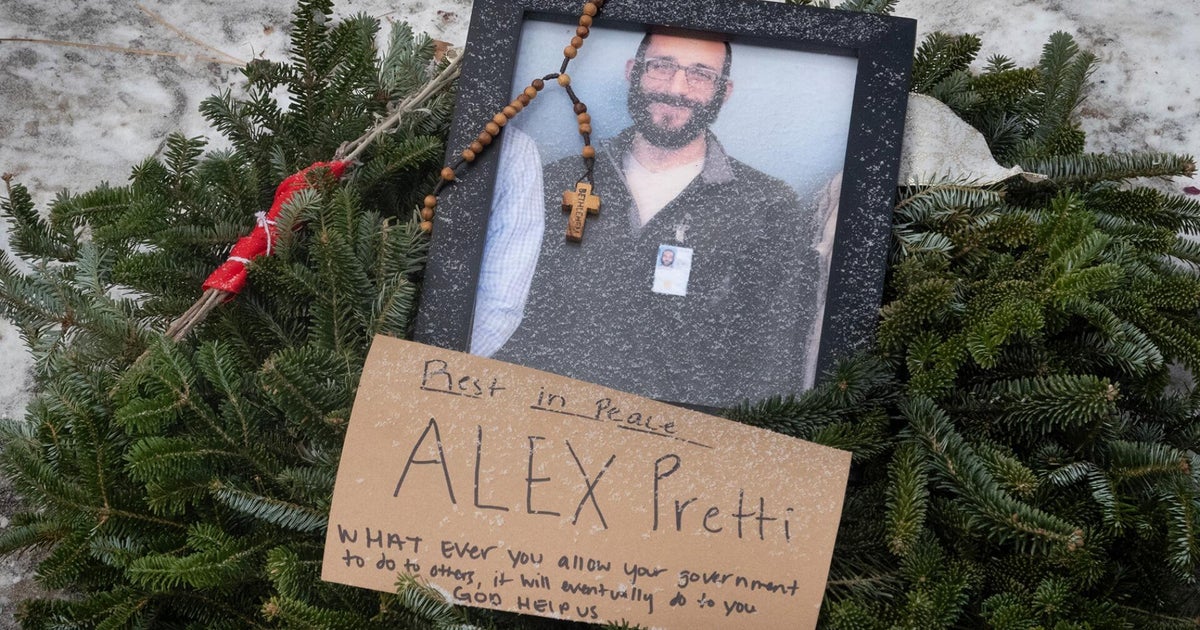

Hawk Resources at its Olympus scandium project in Western Australia.

HAWK RESOURCES LIMITED (ASX: HWK)

Up 150% (1.8c – 4.5c)

Snagging third spot this week is scandium scouter Hawk Resources, which has muscled into WA’s critical minerals market with a $5 million capital raise to fund its latest 80 per cent earn-in on the Olympus scandium project. Scandium by the way sells for about $US3.5m a tonne and puts minerals like nickel at US$15,000 a tonne and copper at US$10,000 a tonne to shame.

Last week’s farm-in adds another string to Hawk’s bow and complements the company’s near-term copper project in Utah.

Olympus sits 150km northeast of Warburton at the NT border and has been previously probed for copper-nickel-PGEs but scandium was not on the radar at the time when a few big scandium hits came back.

A review of old pXRF soils lit up for a huge 4km by 7km anomaly. Grades up to 1284 parts per million (ppm) scandium were spotted, with historic drilling peaking at a substantial 2164ppm over a metre.

Other promising holes include a 5m hit running 948ppm from surface including 3m at 1139ppm, shallow hits that were ignored in favour of nickel ansd copper at the time. With critical minerals exciting everyone and everything right now however Scandium, the alloy wunderkind that toughens and lightens aluminium is now a thing.

Hawk’s stock took off post the announcement and was up 150 per cent from 1.8c to 4.5c on a frenzy of than $2 million of shares traded post deal.

Thor Energy uranium waste dumps will be reprocessed to supply a no-cost stream of uranium concentrate to market.

THOR ENERGY LIMITED (ASX: THR)

Up 93% (1.4c – 2.7c)

An honourable mention in the Runners cavalcade this week goes to end-to-end critical minerals player Thor Energy, after it sealed a binding pact with US metals recovery whiz, DISA Technologies, to extract uranium.

Thursday’s binding agreement green-lit the treatment of abandoned Colorado uranium waste dumps to pull saleable uranium concentrates and additional critical bi-products.

DISA, more importantly, just snagged the US Nuclear Regulatory Commission’s first-ever service providers licence for mine waste remediation.

Its patented high-pressure slurry ablation system is chemical-free and scrubs 90 per cent uranium and radium-226 from dumps, spitting out two clean solid streams.

Thor will lock in 25 per cent of the uranium rights from thirteen waste dumps surveyed already, a portfolio the company says is likely to expand.

DISA will foot all the bills and evaluate all permitting treatment remediation, allowing Thor to pocket sliding-scale royalties on gross sales of between 2.5 and 4 per cent based on metal prices.

The zero capex and opex burn deal locks in pure upside for Thor.

The company says proceeds will fuel its Aussie hydrogen helium hunt at the High Range project in South Australia, a 6500 square-kilometre package, with high-impact drill targets prime for testing.

Maiden campaigns are now being prepped and follow neighbouring ASX company Gold Hydrogen’s Ramsay project hits of hydrogen and helium, which shot that company up more than $100 million in market cap.

Uranium waste looks to be the low-hanging fruit and the market ate it up. Thor’s shares got all stratospheric, up 93 per cent to a high of 2.7c from last week’s close of 1.4c on $2.5 million in shares traded.

Is your ASX-listed company doing something interesting? Contact: [email protected]