Kevin PeacheyCost of living correspondent

Getty Images

Getty Images

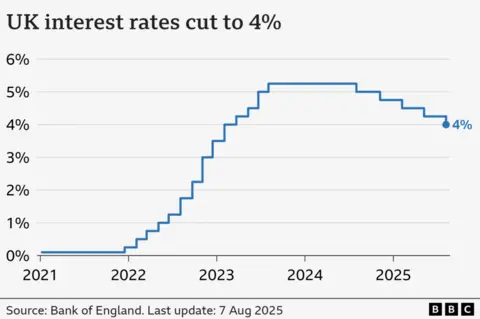

Interest rates are widely expected to be held at 4% when policymakers at the Bank of England meet on Thursday.

The Bank rate, which heavily influences borrowing costs and savings rates, was cut from 4.25% to 4% by the Bank's Monetary Policy Committee (MPC) at its last meeting in August.

It took the rate down to its lowest level for more than two years, but many analysts believe there will be no further cuts during the rest of this year.

The decision will be revealed at 12:00 BST and comes after official data on Wednesday showed prices were rising at nearly twice the target level, driven by the higher cost of food.

The rate of inflation remained at 3.8% in August, well above the 2% target. The Bank rate is policymakers' main tool for controlling inflation.

In theory, making borrowing more expensive means people have less money to spend, which slows prices rises. However, increasing borrowing costs can also harm the economy.

Closely-watched vote

The decision to cut the Bank rate in August was taken after an unprecedented second vote by the nine members of the MPC.

Andrew Bailey, governor of the Bank, said the decision to cut interest rates was "finely balanced".

Analysts expect Thursday's vote to be more clear cut, with no change expected.

The relatively high rate of inflation means policymakers are unlikely to risk pushing that higher by cutting the Bank rate.

However, they do expect the inflation rate to start to drop soon, which leaves the possibility open of further interest rate cuts.

The Bank rate has a big impact on the interest homeowners face when taking out a new fixed-rate mortgage.

Lenders use the Bank rate to set their own rates. As a result, the expectation of interest rate rises can push up mortgage rates while the expectation of interest rate cuts can pull mortgage rates down.

Mortgage rates have dropped very slightly since the MPC's last meeting in August, but further moves are uncertain, according to Rachel Springall, from the financial information service Moneyfacts.

"Many will be waiting with bated breath for the Budget. This waiting game, alongside forecasts for inflation to remain above target, makes it less likely for the Bank of England to make further rate cuts this year," she said.

She said that savers had seen a downward trend in returns during the time when the Bank has been lowering the Bank rate.

"The average easy access [savings] rate has fallen further below 3%, so savers must act now and switch their variable rate account if it no longer pays a decent return on their hard-earned cash," she said.

Global picture

The government would be keen to see interest rates fall further, to boost growth in the UK economy.

The Resolution Foundation think-tank, which which focuses on those on low to middle incomes, said living standards needed to improve after a "lost" 20 years of growth.

But ministers will be aware of the inflationary risk that remains in the UK, especially as prices are rising slower in countries such as the US, Germany, and France.

Thursday's MPC decision will come after the US central bank chose to cut interest rates on Wednesday to a range of 4% to 4.25% for the first time since December.

Last Thursday, the European Central Bank chose to hold its interest its at 2%.

3 weeks ago

10

3 weeks ago

10